tax sheltered annuity vs 401k

A 403 b plan tax-sheltered annuity plan or TSA is a retirement plan offered by public schools and certain charities. Annuities are generally offered.

The 401k Vs 403b Plan Find The Legal Difference Between Cc

Plan a supplemental plan a tax-sheltered annuity TSA or simply a 403b plan.

. A 403 b plan often referred to as a tax-sheltered annuity account TSA is a retirement plan offered exclusively by public schools and certain charities. An annuity thats considered tax-sheltered is a way for employees of tax-exempt organizations and the self-employed to generate retirement income with pretax dollars. This was despite annuity products remaining the most popular option among tax-sheltered annuity plan participants.

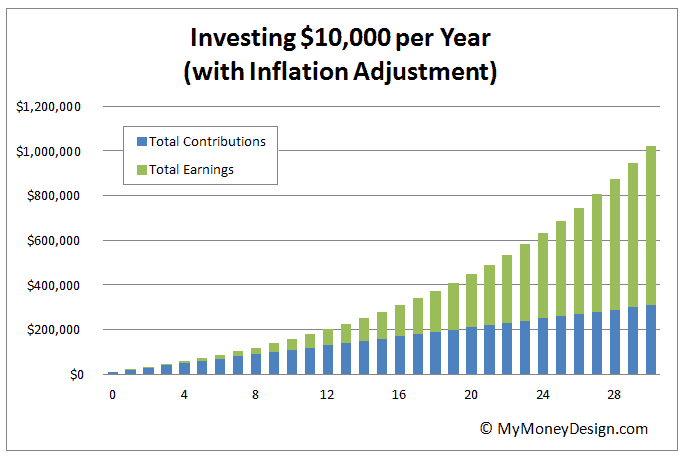

How Annuities Benefit A 401k Annuities are flexible investment solutions that may help you achieve your long-term financial goals and provide a source of retirement income. A 403 b plan is very similar to 401. They enable participants to invest pre-tax funds in an annuity or.

Annuity is a life-insurance policy which is setup to work as the investment plan where a contract is made between a participant and an insurance company in which participant give money to. While anybody can buy an annuity only people whose employers have 401k plans can contribute to one. Instead you pay ordinary income tax on the distributions from your 401 k.

457b Tax Sheltered Annuity. An annuity is a contract with an insurance. 401K vs Annuity.

Ad Learn More about How Annuities Work from Fidelity. Nonprofits and public education institutions can establish tax-sheltered annuity plans often known as 403 b plans. Here is the complete annuity formula to understand the.

A tax-sheltered annuity is a retirement savings plan that allows employees of tax-exempt organizations and self-employed people to invest pretax dollars to build retirement. Guaranteed income starting immediately. A 403 b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501 c 3 tax-exempt.

Major Differences Between Annuities and 401ks. Both 401k and annuities being instruments of saving for your retirement knowing the differences between them is important. 401 k contributions are deducted directly from your salary so you dont pay taxes on them right away.

How Much Income Does An Annuity Pay. Ad Learn More about How Annuities Work from Fidelity. The payments can be made for a specific number of years or the rest of your life.

Funds invested in a 401k do not have the same protection from creditors as those invested in a 401k. A TDA plan is an employer-sponsored Defined Contribution retirement plan to which you can contribute a. Ad If you have a 500000 portfolio download your free copy of this guide now.

However you contribute to annuities with after-tax dollars while you contribute to traditional 401ks with pre-tax dollars. A 401k plan is an employer-sponsored fund that holds your retirement savings and allows it to grow on a tax-deferred basis. Compare Live Annuity Rates From Over 25 Top Rated Companies.

Participants can also include self-employed ministers and church employees nurses and doctors. When its time to withdraw money in retirement you will. Ad Our 3-Minute Confident Retirement check can help you start finding the answers.

Its similar to a 401 k plan maintained by a for-profit entity. According to the IRS a 403 b plan or tax-sheltered annuity TSA differs from a 401 k in that it can only be offered by public schools and certain tax-exempt organizations. Ad Get The Most Income.

Get started and take the 3-Minute Confident Retirement check to start finding answers. Ad Compare income annuity quotes from across the market quickly and for free. Before enrolling in a TSA like a 403b plan make sure to check the.

A tax-sheltered annuity TSA is a pension plan for employees of. Although 401k plans are the most popular an alternative known as a tax-sheltered annuity or TSA plan is available to many workers especially in the nonprofit world. Income Annuity Quotes From Top-Rated Insurers.

One of the main advantages of an annuity is that it can provide a stream of income that you cannot outlive. Your tax-advantaged investment comes at a cost since both annuities and 401k accounts typically have higher management costs than investing directly in stocks or funds.

Taxation Of Annuities Ameriprise Financial

Differences And Similarities Between An Annuity And 401 K

403 B Vs 401 K Which Is The Better Plan Pros And Cons

The Tax Sheltered Annuity Tsa 403 B Plan

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Annuity Vs 401 K What S The Difference Forbes Advisor

Understanding The Annual Reset Method The Annuity Expert

Massmutual What S In A Name A Retirement Plan Comparison

Withdrawing Money From An Annuity How To Avoid Penalties

/dotdash-comparing-iul-insurance-iras-and-401ks-Final-71f14693e37d4fb1b0736112179802b5.jpg)

Understanding Indexed Universal Life Insurance Vs Iras 401 K S

Withdrawing Money From An Annuity How To Avoid Penalties

/156532699_Dimitri-Otis_DigitalVision_GettyImages_annuity-56a635ef5f9b58b7d0e06bc3.jpg)

What Are The Risks Of Rolling My 401 K Into An Annuity

The Hierarchy Of Tax Preferenced Savings Vehicles

403 B Vs 401 K What S The Difference How Are They The Same

Tax Sheltered Annuity Faqs Employee Benefits

Annuity Taxation How Various Annuities Are Taxed

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)